退休期间你会交税吗?

你可能知道你在个人退休账户(IRA)或401(k)计划中为退休存了多少钱,以及你是从社会保障还是养老金中得到钱。但是,你知道这些钱将如何征税吗?您的申报状况、您的退休收入来源以及您每年获得的收入总额将决定您的退休税。你的税收会影响你的生活。

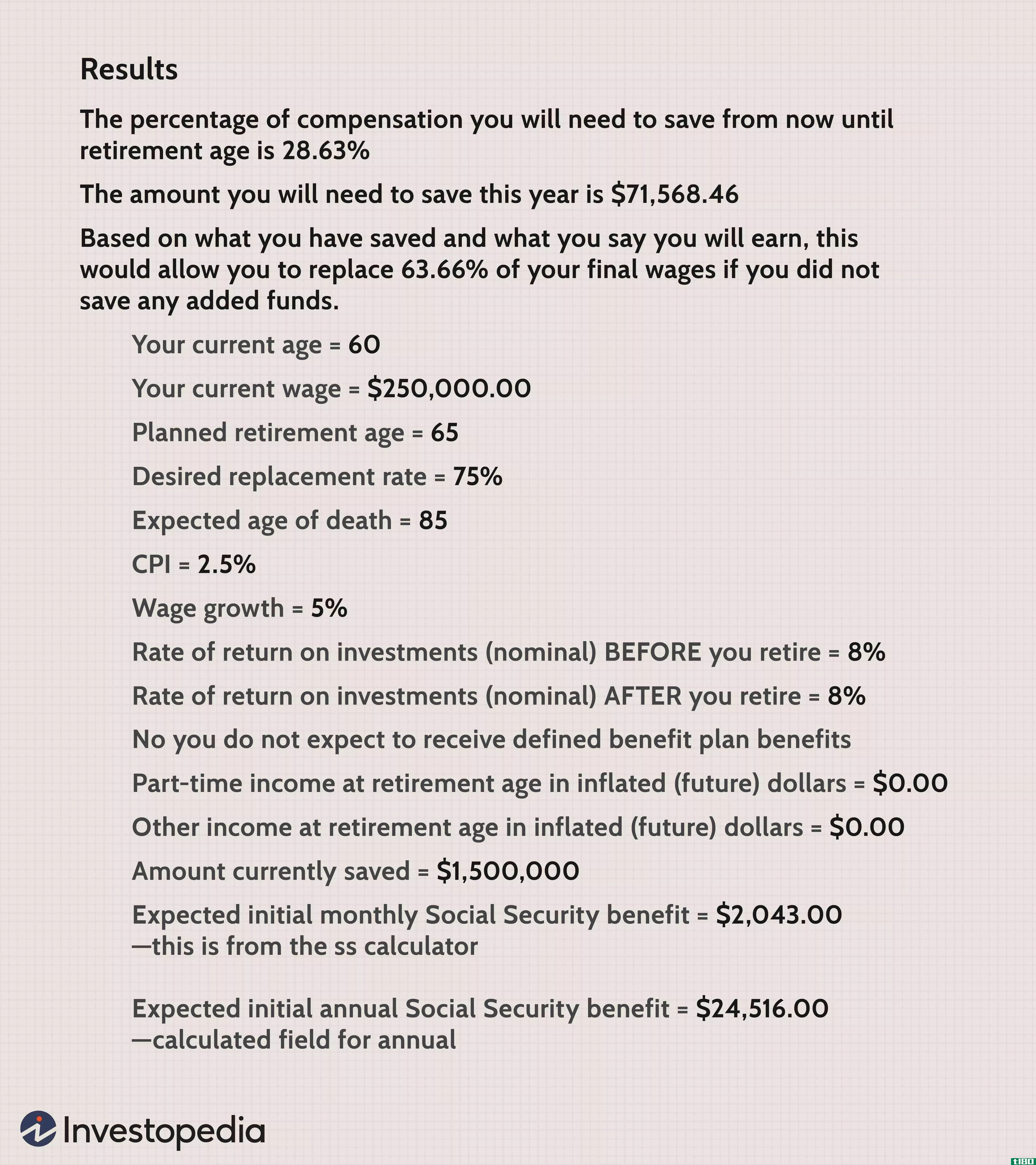

了解你的退休收入将如何纳税是很重要的。如果你还没有退休,还在工作,了解这些信息可以帮助你计算出税后的收入。如果你的税后收入似乎不足,你可以估计你需要存多少钱才能退休。如果你已经退休了,它会告诉你是否需要做一些额外的计划,以避免资金耗尽。了解税收如何影响你的退休收入可以帮助你考虑如何减少你的税单和最大限度地提高你的退休收入。

关键要点

- 根据您的总收入和您的申报状况,您的社会保障福利中最多有85%是应纳税的。

- 即使你在领取社保时继续工作,如果你是雇员,你将从工资中扣除社保和医疗保险税,如果你是自营职业者,你将不得不直接支付这些税。

- 401(k)和传统个人退休账户的分配通常是应税的。

- Roth IRA的分配是免税的。

- 联邦税法和一些州法律为退休人员和老年纳税人提供特殊福利。

退休后社保如何征税?

如果社会保障是你唯一的收入来源,你可能就不需要为此纳税了:你的收入太低了,不需要纳税。但是,如果您有其他收入来源,包括其他免税利息收入,您的部分社会保障福利可能需要纳税。

超过一半的社保受益人为他们的福利缴税。根据社保局的数据,1984年领取社保福利并须缴纳所得税的家庭比例不到10%,到2015年超过50%,在2015年至2050年间可能上升到56%。

应税社会保障福利的金额取决于您的“综合收入”,即(1)本年度所有社会保障福利的50%,(2)调整后的总收入(“AGI”)加上(3)免税利息收入,如市政债券利息。

您的AGI是您的总(总)收入减去该收入的调整,如扣除和排除。总收入的共同来源包括工资、薪金、小费、利息、股息、IRA/401(k)分配、养老金和年金。

对总收入的常见调整包括健康储蓄账户供款、个人退休账户供款扣除额、学生贷款利息扣除额和自营职业退休计划供款。

你的“综合收入”水平决定了你的社保福利中应税的部分。下表显示了您的社保福利在不同综合收入水平下应纳税的百分比:

| Individual Return | |

| $0 to $24,999 | No tax |

| $25,000 to $34,000 | Up to 50% of SS may be taxable |

| More than $34,000 | Up to 85% of SS may be taxable |

| Married, Joint Return | |

| $0 to $31,999 | No tax |

| $32,000 to $44,000 | Up to 50% of SS may be taxable |

| More than $44,000 | Up to 85% of SS may be taxable |

| Married, Separate Return | |

| $0 and up | Up to 85% of SS may be taxable |

How Much Income Can a Retiree Receive Without Paying Taxes?

It depends on the sources and total of your income. These income sources may include retirement account distributi*** from 401(k)s and IRAs, Social Security benefits, pension payments, and annuity income. Some people may also continue to earn some income from work, as an employee or through self-employment, even though they may have retired from their regular or long-term employment.

Earned income

Workers nearing retirement often ask, “How much income can a retiree receive without paying taxes?” It depends on your income sources and total. The Internal Revenue Service (IRS) differentiates between income types it classifies as earned and unearned.

Earnings from employment and self-employment are subject to Social Security, Medicare, and income taxes. Unearned income—for example, income from pensi***, IRAs, annuities and other investments—is subject to income tax under rules that vary by the income’s source.

If you are receiving Social Security benefits and continue to work and earn income, you will have to pay Social Security and Medicare taxes on that earned income. However, if the total of your earned income, any unearned income and Social Security benefits is low enough, you will not owe federal income tax on it. If your AGI is equal to or less than the standard deduction for your filing status, your federal income tax liability likely is zero. (See 2020 and 2021 Standard Deducti*** for Retirees, below.)

Income from IRAs, pensi***, 401(k)s and other plans

Some types of income are “unearned,” but that doesn’t mean they aren’t subject to income tax. Income from different sources may be subject to different tax rules. Ultimately, a retiree’s tax liability depends on the tax bracket applicable to his or her total taxable income.

If you claimed tax deducti*** for your contributi*** to a traditional IRA, the distributi*** from that IRA may be taxable, depending on the total of all your income. Similarly, distributi*** from a 401(k) account or other “qualified” retirement account funded with “before tax” contributi*** are taxable. If your employer funded your pension plan, your pension income is taxable. Both your income from these retirement plans as well as your earned income are taxed as ordinary income at rates from 10% to 37%.

Some individuals make “after-tax” contributi***, i.e., contributi*** for which they do not claim tax deducti***, to their IRAs. Occasionally, other types of retirement plans also are funded with after-tax contributi***. The distributi*** from such plans are not taxed to the extent that the distributi*** represent the return of previously taxed contributi***. The information return, Form 1099-R, sent to a taxpayer who made after-tax contributi*** to plans will report both the gross amount distributed as well as the taxable amount.

IRAs, 401(k)s, and similar plans are required to make annual “required minimum distributi***” or RMDs to beneficiaries, beginning in the year they turn 72 years of age. The RMD requirement was suspended for the 2020 tax year in legislation enacted in resp***e to the pandemic but will apply in 2021.

Roth IRA and Roth 401(k) distributi*** are not taxable. Roth plans, which are funded with after-tax dollars, do not have an RMD requirement.

Income such as dividends, rents, and taxable interest from investments held outside IRAs, 401(k)s and similar plans is subject to tax at ordinary income rates ranging up to 37%. Capital gains rates apply to gains realized on the sale of investments. Long-term capital gains are taxed at low rates, ranging from a zero rate bracket to a rate of 20% for taxpayers with very high taxable incomes.

Because older people often have several types of taxable income, both earned and unearned, their tax rate and liability depends on the tax bracket that corresponds to their total taxable income. You determine your tax bracket in retirement the same way you did while you were working. Add up your sources of taxable income, subtract your standard or itemized deducti***, apply any tax credits you’re eligible for, and check the tax tables in the instructi*** to Form 1040 and 1040 SR—or, more likely, put all this information into a tax software program or give it to your accountant.

Standard Deducti*** for Retirees

For 2020, the standard deduction amounts are $12,400 for single and separate returns of married pers***, $24,800 for joint returns, and $18,650 for head-of-household returns. The standard deducti*** for 2020 are used on tax returns filed in 2021 for the prior tax year. The standard deduction for 2021 is $12,550 for single taxpayers and married taxpayers filing separately, $25,100 for married taxpayers filing jointly, and $18,800 for heads of household. The standard deducti*** for 2021 are used on tax returns filed in 2022.

In addition, taxpayers who are 65 years of age or older—whether or not they are retired—are eligible for an extra standard deduction of $1,650 for 2020 and $1,700 for 2021, if they are single or heads of household (and not married or a surviving spouse) and an extra $1,300 for 2020 and $1,350 for 2021, per senior spouse if they are married filing jointly, married filing separately, or a qualified widow(er). For details, see the charts below.

| Filing Status | Standard Deduction | Senior Bonus | Total Deduction |

| Single | $12,400 | $1,650* | $14,050 |

| Married filing jointly or qualified widow(er) | $24,800 | $1,300 per senior spouse | $26,100 or $27,400 |

| Married filing separately | $12,400 | $1,300 | $13,700 |

| Head of household | $18,650 | $1,650* | $20,300 |

| Filing Status | Standard Deduction | Senior Bonus | Total Deduction |

| Single | $12,550 | $1,700* | $14,250 |

| Married filing jointly or qualified widow(er) | $25,100 | $1,350 per senior spouse | $26,450 or $27,800 |

| Married filing separately | $12,550 | $1,350 | $13,900 |

| Head of household | $18,800 | $1,700* | $20,500 |

- If unmarried and not a surviving spouse, otherwise $1,300 in 2020 and $1,350 in 2021.

If your taxable total income is less than these amounts, you won’t owe any taxes. You usually won’t even have to file a tax return (unless you are married filing separately),though you may want to anyway. Filing a return allows you to claim any credits for which you might be eligible, such as the tax credit for the elderly and disabled or the earned income credit. Filing a return also ensures that you receive any refund you may be owed.

Taxpayers who itemize deducti*** may not claim the standard deduction and bonus amounts. It should be noted that recent increases in the standard deduction amounts mean that the threshold where older taxpayers benefit more from itemizing than taking the standard deduction is higher. These higher standard deduction levels might affect your decisi*** about when to make charitable donati*** or pay other deductible expenses. You may be able to benefit from itemizing in some years if you can lump large itemizable expenses together so that they fall within a single tax year.

For 2020, a special benefit for certain charitable contributi*** is available to non-itemizers. Taxpayers who claim the standard deduction on their tax returns can deduct up to $300 of charitable contributi*** made in cash "above-the line," that is, in calculating their adjusted gross income (AGI). Certain types of contributi*** are not eligible for the $300 deduction, including (1) gifts of noncash property, such as gifts of securities; (2) contributi*** to private non-operating foundati***; (3) donati*** to supporting organizati*** and new or existing donor-advised funds; (4) contributi*** to veterans’ organizati***, fraternal societies and certain cemetery and burial companies; and (5) contribution carryforwards from earlier years.

Tax Brackets for 2020

For the 2020 tax year, the top rate is 37% for individual single taxpayers with incomes greater than $518,400 ($622,050 for married couples filing jointly). The other rates and brackets are as follows:

| 2020 Rate | Married Joint Return | Single Individual | Head of Household | Married Separate Return |

| 10% | $19,750 or less | $9,875 or less | $14,100 or less | $9,875 or less |

| 12% | $19,751 to $80,250 | $9,876 to $40,125 | $14,101 to $53,700 | $9,876 to $ 40,125 |

| 22% | $ 80,251 to $171,050 | $40,126 to $ 85,525 | $53,701 to $85,500 | $40,126 to $ 85,525 |

| 24% | $171,051 to $326,600 | $85,526 to $163,300 | $85,501 to $163,300 | $85,526 to $163,300 |

| 32% | $326,601 to $414,700 | $163,301 to $207,350 | $163,301 to $207,350 | $163,301 to $207,350 |

| 35% | $414,701 to $622,050 | $207,351 to $518,400 | $207,351 to $518,400 | $207,351 to $311,025 |

| 37% | Over $622,050 | Over $518,400 | Over $518,400 | Over $311,025 |

Tax Brackets for 2021

For the 2021 tax year, the top tax rate remains 37% for individual single taxpayers with incomes greater than $523,600 ($628,300 for married couples filing jointly). The other rates and brackets are as follows:

| 10% | $19,900 or less | $9,950 or less | $14,200 or less | $9,950 or less |

| 12% | $19,900 to $ 81,050 | $9,951 to $40,525 | $14,201 to $54,200 | $9,951 to $ 40,525 |

| 22% | $81,051 to $172,750 | $40,526 to $ 86,375 | $54,201 to $86,350 | $40,526 to $86,375 |

| 24% | $172,751 to $329,850 | $86,376 to $164,925 | $86,351 to $164,900 | $86,376 to $164,925 |

| 32% | $329,851 to $418,850 | $164,926 to $209,425 | $164,901 to $209,400 | $164,926 to $209,425 |

| 35% | $418,851 to $628,300 | $209,426 to $523,600 | $209,401 to $523,600 | $209,426 to $314,150 |

| 37% | Over $628,300 | Over $523,600 | Over $523,600 | Over $314,150 |

The Bottom Line

Will you pay taxes in retirement? Unless your taxable income falls at or below the standard deduction level every year, you probably will. How much you’ll pay is another story. There are many ways to help retirees minimize their tax burden. Strategies include timing distributi***, bunching income, bunching deducti*** that can be itemized, and doing retirement account conversi***.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

-

Internal Revenue Service. “Don’t forget, Social Security benefits may be taxable.” Accessed March 13, 2021.

-

Social Security Administration. “Income Taxes on Social Security Benefits,” Accessed March 13, 2021.

-

SSA. “Retirement Benefits, 2021.” Pages 12-13. Accessed Jan. 11, 2021.

-

IRS. Pub. 554, Tax Guide for Seniors. Pages 4, 12, 19. Accessed Jan 3, 2021.

-

IRS. "2020 Schedule 1, Additional Income and Adjustments to Income." Accessed Jan. 3, 2021.

-

IRS. "What Is Earned Income?" Accessed Jan. 3, 2021.

-

IRS. "Publication 554: Tax Guide for Seniors," Page 12. Accessed Jan. 3, 2021.

-

IRS. “IR-2019-280,” Nov. 6, 2019.Accessed Jan. 3. 2021.

-

IRS. “IR-2020-245,” Oct. 26, 2020. Accessed Jan. 3, 2021.

-

Internal Revenue Service. "IRS Rev. Proc. 2019-44." Accessed March 13, 2021.

-

Internal Revenue Service. "Rev. Proc. 2020-45." Accessed March 13, 2021.

-

IRS. "Draft Form 1040 Tax Year 2020." Dec. 15, 2020, Page 9. Accessed Jan. 3, 2021.

-

IRS. "Publication 554: Tax Guide for Seniors," Pages 26-31. Accessed Jan. 3, 2021.

-

IRS. “Year-end reminder: Expanded tax benefits help individuals and businesses give to charity during 2020.” IR-2020-278, Dec.18, 2020. Accessed Jan. 3, 2021.

-

Internal Revenue Service. “IRS provides tax inflation adjustments for tax year 2020,” Accessed Jan. 3. 2021.

Compare Accounts

Advertiser Disclosure

×

The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Provider

Name

Description

Related Articles

401K

Can Your 401(k) Impact Your Social Security Benefits?

Income Tax

Do Tax Brackets Include Social Security?

Social Security

How to Avoid Paying Taxes on Social Security Income

401K

10 Ways to Reduce Your 401(k) Taxes

Taxes

What You Need to Know About Your 2020 Taxes

401K

How Is Your 401(k) Taxed When You Retire?

Partner Links

Related Terms

Earned Income

Earned income includes wages, salaries, bonuses, commissi***, tips, and net earnings from self-employment.

moreTax Brackets: Determine How Much You Owe

A tax bracket is the rate at which an individual is taxed. Tax brackets are set based on income levels.

moreTaxable Income

Taxable income is the portion of an individual's or company's income used to calculate how much tax they owe the government in a given tax year.

moreWhat's an Individual Retirement Account (IRA)?

An individual retirement account (IRA) is a tax-advantaged account that individuals use to save and invest for retirement.

moreExempt Income

Exempt income refers to earnings that are protected from federal income tax under certain circumstances.

moreMarriage Penalty

The marriage penalty refers to the increased tax burden for married couples compared to filing separate tax returns as singles.

more- About Us

- Terms of Use

- Dictionary

- Editorial Policy

- Advertise

- News

- Privacy Policy

- Contact Us

- Careers

- California Privacy Notice

- #

- A

- B

- C

- D

- E

- F

- G

- H

- I

- J

- K

- L

- M

- N

- O

- P

- Q

- R

- S

- T

- U

- V

- W

- X

- Y

- Z

Investopedia is part of the Dotdash publishing family.

- 发表于 2021-05-31 23:58

- 阅读 ( 404 )

- 分类:商业金融

你可能感兴趣的文章

你真的能提前交税吗?

...RS表格1040-ES计算预计付款。如果你认为当税收季节来临时你会欠一吨钱,你也可以用W-2雇员的估计付款。这很复杂,但如果你的扣缴金额低于一定数额,就会受到处罚。你唯一能做的另一个“预付款”就是把你的退款用于你明年...

- 发布于 2021-05-12 10:16

- 阅读 ( 262 )

关于选择退休计划你需要知道的一切

...的是,“完全不征税”不是一个选择。但是,当谈到你的退休储蓄时,你确实可以控制何时支付山姆大叔。这篇文章最初出现在《消费主义》杂志上。根据美国国家经济研究局(National Bureau for Economic Research)最近的一项研究,...

- 发布于 2021-05-23 02:30

- 阅读 ( 178 )

需要降低你的税单吗?向爱尔兰共和军捐款

到目前为止,我们大多数人都知道,个人退休账户是一项不错的退休投资,但它也为你节省了一大笔税款。Emily Brandon为《美国新闻》撰文解释道:2012年,员工最多可向个人退休账户缴纳5000美元,如果年龄在50岁或以上,则可缴...

- 发布于 2021-05-24 05:37

- 阅读 ( 133 )

如何努力成为百万富翁

...可及的白日梦。有了周密的计划、耐心和明智的储蓄,你退休时可以轻松地赚一百万美元。 关键要点 如果你想成为百万富翁,你能做的最重要的事情就是早点开始,这样你就可以利用复利。 控制你的开支。你会有更多的钱...

- 发布于 2021-06-03 13:28

- 阅读 ( 290 )

想在5年后退休吗?你必须知道的

退休前的最后五年可能是退休计划中最关键的一年,因为你必须在这段时间内决定你是否真的有能力辞职。决心将在很大程度上取决于你迄今为止所做的准备和准备的结果。 如果你有经济上的准备,你可能只需要维持你的计划...

- 发布于 2021-06-15 09:56

- 阅读 ( 179 )