经常账户赤字:政府投资还是不负责任?

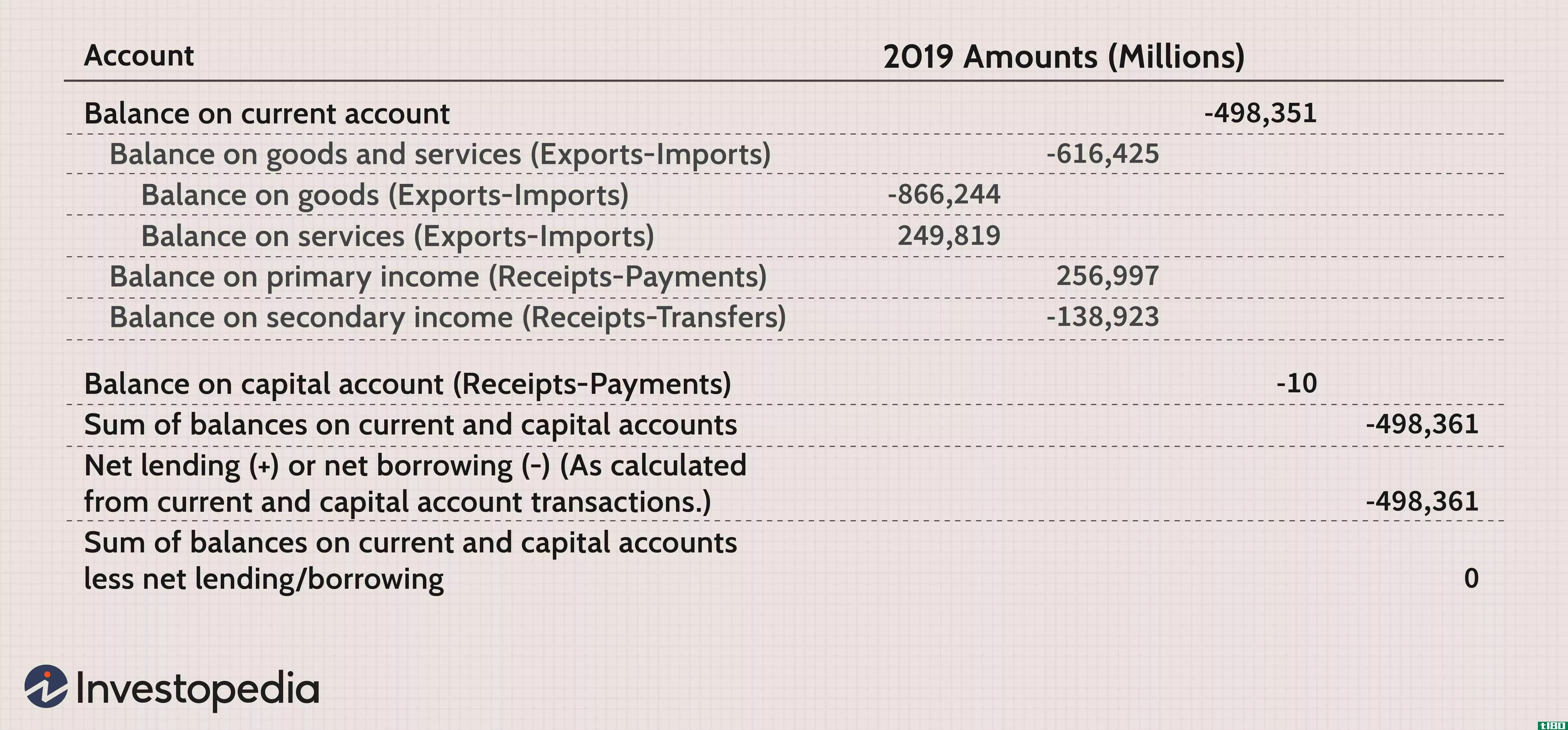

经常账户是一国国际收支(BOP)中记录其经常**易的部分。该账户分为四个部分:商品、服务、收入(如工资和投资收入)和单方面转账(如工人汇款)。

当一个国家的经常账户赤字超过构成该账户的四个因素中的一个或多个时,就会出现经常账户赤字。当当前交易进入账户时,记录为贷方;当一个值离开帐户时,它被标记为借方。基本上,经常账户赤字发生在支付的钱比流入的钱多的时候。

赤字意味着什么

当一个经常账户出现赤字时,通常意味着一个国家在国外的投资多于在国内的储蓄。通常,决定一个国家投资决策的逻辑是,赚钱需要钱。为了提高国内生产总值(GDP)和未来增长,一个国家可能会负债,承担对其他国家的债务。然后,它就成为世界上所谓的“净债务国”。然而,如果一国**没有规划出一个健全的经济政策,没有将债务用于消费目的,而不是用于未来的增长,就可能产生有问题的赤字(有关更多信息,请参阅国债和**债券。)

经常账户赤字意味着一个国家的经济是靠借来的手段运转的。换言之,其他国家基本上是在为经济融资,从而维持赤字。在确定一个国家的经济健康状况时,重要的是要了解赤字的来源、资金来源以及缓解赤字的可能办法。要做到这一点,我们不仅要看经常账户,还要看国际收支的另外两个部分,即资本账户和金融账户。

The Capital and Financial Accounts Foreign funds entering a country from the sale or purchase of tangible assets - as opposed to non-physical assets such as stocks or bonds - are recorded in the capital account of the BOP. (Again, money entering the account is noted as a credit, and money leaving the account is a debit.) Financial transacti*** such as money leaving the country for investment abroad are recorded in the financial account. Together, these two accounts provide financing for a current account deficit.为什么会出现赤字?

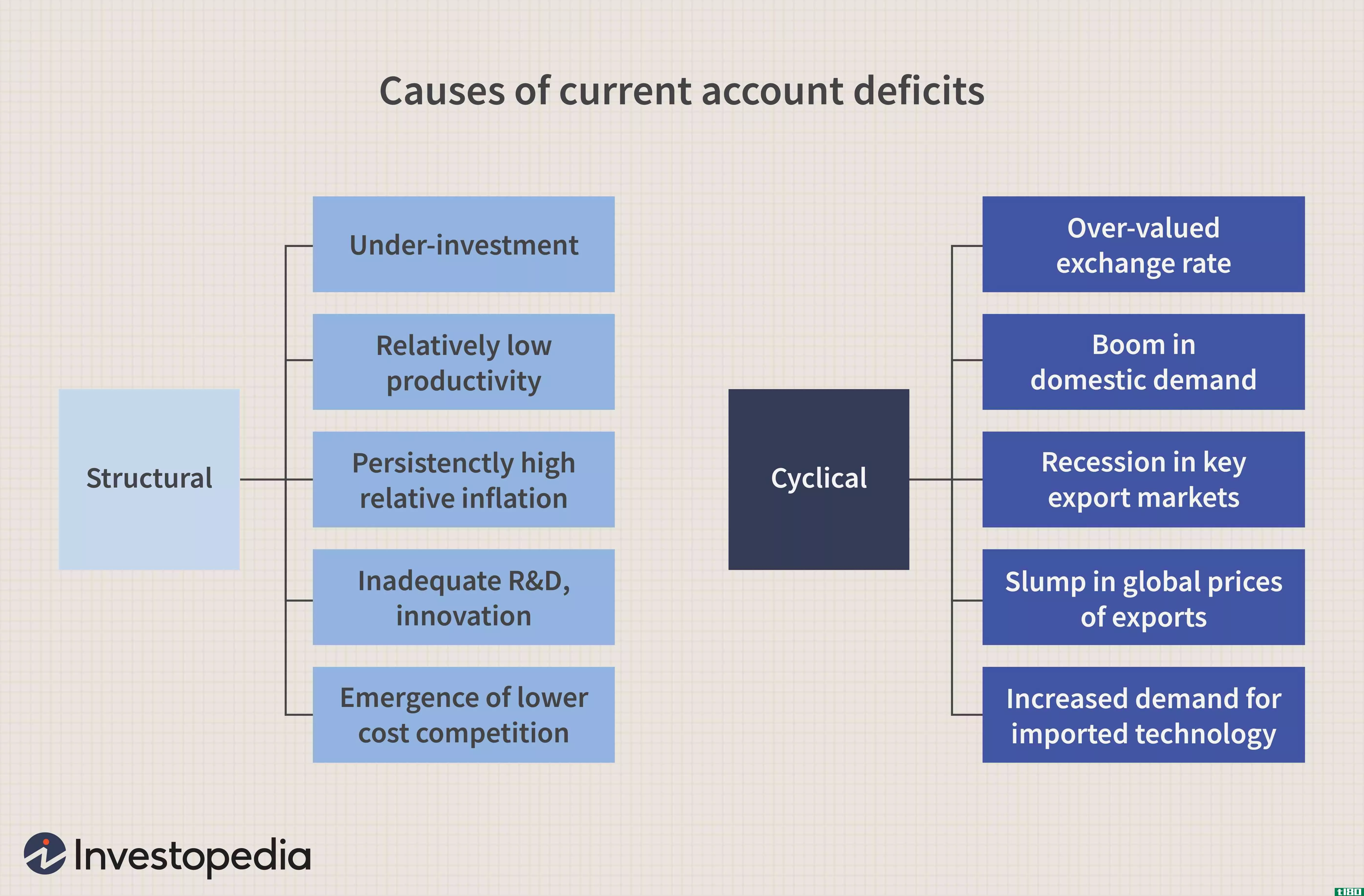

经常账户赤字仅仅是**糟糕的计划和/或无法控制的支出和消费的问题吗?嗯,有时候。但更多的时候,赤字计划是为了帮助一个经济体的发展和增长。这也可能是一个强劲的经济迹象,是外国资金的避风港(我们将在下面解释这一点)。当一个经济体处于转型或改革状态,或者正在推行积极的增长战略时,今天的赤字可以为明天的国内消费和投资提供资金。以下是一些国家经历的计划内和计划外赤字类型。

Balance of Trade Deficit With the long-term in mind, a country may run a deficit by importing more than it's exporting, with the ultimate goal of producing finished goods for export. In this scenario, the country will plan to pay off the temporary excess of imports at a later time with proceeds made from future export sales. The proceeds made from these sales would then become a current account credit. (To learn more, read In Praise Of Trade Deficits.)Investing for the Future Instead of saving money now, a country could also choose to invest abroad in order to reap the rewards in the future. The outing funds would be recorded as a debit in the financial account, while the corresponding incoming investment income would eventually be earmarked as a credit in the current account. Often, a current account deficit coincides with depletion in a country's foreign reserves (limited resources of foreign currency available to invest abroad).Foreign Investors When foreign investors send money into the domestic economy, the latter must eventually pay out the returns due to the foreign investors. As such, a deficit may be a result of the claims foreigners have on the local economy (recorded as a debit in the current account). This kind of deficit could also be a sign of a strong, efficient and transparent local economy, in which foreign money finds a safe place for investment. The United States capital market, for example, was seen as such when "quality assets" were sought out by investors burned in the Asian crisis. The U.S. experienced a surge of foreign investment into its capital markets. And while the U.S. received money that could help increase domestic productivity and hence expand its economy, all of those investments would have to be paid off in the form of returns (dividends, capital gains), which are debits in the current account. So a deficit could be the result of increased claims by foreign investors, whose money is used to increase local productivity and stimulate the economy.Overspending Without Enough Income Sometimes governments spend more than they earn, simply due to ill-advised economic planning. Money may be spent on costly imports while local productivity lags behind. Or, it may be deemed a priority for the government to spend on the military rather than economic production. Whatever the reason, a deficit will ensue if credits and debits do not balance.为赤字融资

Public and Private Foreign Funds Funding channeled into the capital and financial accounts (remember, these accounts finance the deficits in the current account) can come from both public (official) and private sources. Governments, which account for official capital flows, often buy and sell foreign currencies. Credit from these sales is recorded in the financial account. Private sources, whether instituti*** or individuals, may be receiving money from some sort of foreign direct investment (FDI) scheme, which appears as a debit in the income section of the current account but, when investment income is finally received, becomes a credit.Balanced Financing To avoid unnecessary extra risks associated with investing money abroad, the financing of the deficit should ideally rely on a combination of long-term and short-term funds rather than one or the other. If, for example, a foreign capital market suddenly collapses, it can no longer provide another country with investment income. The same would be true if a country borrows money and political differences cut the credit line. However, by planning to receive recurrent investment income over the years, such as by means of an FDI project, a country could intelligently finance its current account deficit.Capital Flight In times of global recession, the financing of a deficit can sometimes be traced to capital flight, that is, private individuals and corporati*** sending their money into "safe" economies. This money is recorded as a credit in the current account but, in reality, it is not a reliable source of financing. In fact, it is a strong indication that the world economy is slowing and may not be able to provide financing in the near future.底线

为了确定一个国家的经济是否疲弱,重要的是要知道为什么会出现赤字以及如何为赤字融资。赤字可能是一些国家经济困难的标志,也可能是其他国家经济健康的标志。为了支持世界各国的经常账户赤字,全球经济必须足够强大,以便能够购买出口和偿还投资收入。然而,经常账户赤字往往不能维持太久——人们广泛争论的是,今天的消费是否会给后代带来长期债务。

- 发表于 2021-06-12 08:43

- 阅读 ( 72 )

- 分类:商业金融

你可能感兴趣的文章

贸易逆差

...“商品”)、服务、货物和服务。国际交易余额也计算为经常账户、资本账户和金融账户。 关键要点 当一个国家在一定时期内进口超过出口时,就会出现贸易逆差。 余额是为几类国际交易计算的 贸易逆差可以是短期的,...

- 发布于 2021-06-01 04:29

- 阅读 ( 144 )

经常项目赤字

什么是经常账户赤字(a current account deficit)? 经常账户赤字是衡量一个国家进口的商品和服务的价值超过出口产品的价值时的贸易额。经常账户包括净收入,如利息和股息,以及转移,如外国援助,尽管这些组成部分只占经常账...

- 发布于 2021-06-03 08:42

- 阅读 ( 156 )

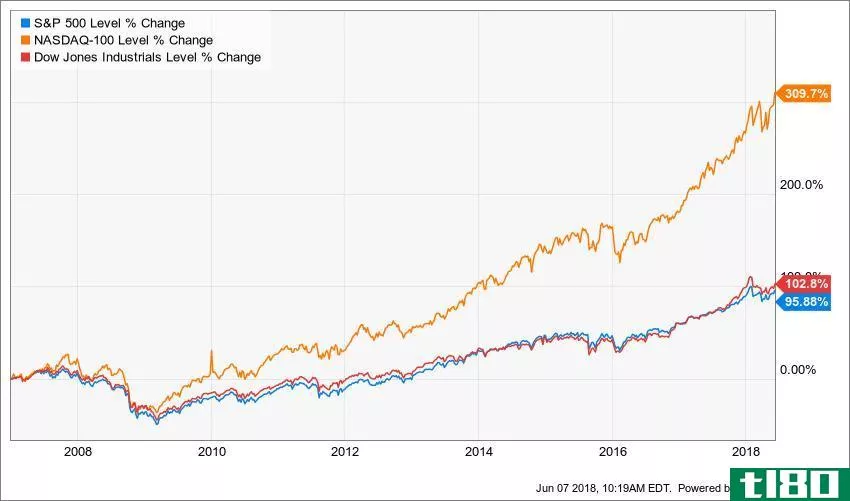

“敢作敢为”股市准备下跌40%:斯托克曼

...润带来巨大提振,但不利的一面是,预计2019年联邦预算赤字将达到惊人的1万亿美元,根据PBS引用的国会预算办公室(CBO)的分析。这让1981年罗纳德·里根(Ronald Reagan)领导下的管理与预算办公室(OMB)主任大卫·斯托克曼(Davi...

- 发布于 2021-06-19 17:24

- 阅读 ( 112 )

国债还是联邦赤字?有什么区别?

...高债务上限,要么像近年来那样再次暂停债务上限 尽管经常有人声称“中国拥有我们的债务”,但财政部报告称,截至2017年6月,中国只持有美国债务总额的5.8%左右,约1.15万亿美元。 二者对经济的影响 随着债务继续增加...

- 发布于 2021-09-18 10:57

- 阅读 ( 363 )

什么是财政责任?(fiscal responsibility?)

...任往往从平衡预算开始,广义上说,平衡预算是一个没有赤字也没有盈余的预算。在这种计划下,对可能花费的和实际花费的期望是相等的。对于维持预算平衡,有许多不同的观点和期望,一些模型主张在某些经济时期出现预算...

- 发布于 2021-12-24 13:22

- 阅读 ( 105 )

什么是赤字支出?(deficit spending?)

...来满足批准的经营预算。发生这种情况时,通过使用信用账户和延期付款计划支付费用,允许实体现在购买,以后支付。 ...

- 发布于 2022-02-05 18:28

- 阅读 ( 225 )

什么是赤字融资?(deficit financing?)

... 赤字融资是一种资金管理方法,涉及支出超过同期收入。这种策略有时被称为预算赤字,企业和小企业、各级政府甚至家庭预算都采用这种策略。如果使用得当,这种融资...

- 发布于 2022-02-06 03:46

- 阅读 ( 158 )

什么是财政赤字?(a fiscal deficit?)

...成本。通常,支出和实际收入之间的差额可以通过从储备账户转移资金、从国家或联邦储备银行系统借款,或通过削减支出使其更符合实际收入来抵消。。 ...

- 发布于 2022-02-06 20:28

- 阅读 ( 175 )

什么是经常账户盈余?(a current account surplus?)

... 经常账户盈余是指某些类型的货币流入一国的速度快于流出的速度。这包括用于出口和进口的货币、利息和股息等货币,以及没有任何回报的货币,如外国援助。经常账户...

- 发布于 2022-02-07 15:37

- 阅读 ( 208 )