注册会计师之间的差异(differences between cpa)和cima公司(cima)的区别

CPA与CIMA

Getting a degree in school is not the end of your requirements especially if you take a Bachelor of Science in Accountancy. If you want to get promoted and want your salary raised, you have to pass the tests and earn a license to become a CPA or a CIMA. If you’re not exactly sure of what you want to be, here are some quick facts regarding the differences between a CPA and a CIMA. Perhaps, “CPA” is a more popular term than CIMA. “CPA” stands for “Certified Public Accountant.” Though individuals who graduated with an accountancy degree can still apply for accounting-related jobs. Their salary is not as high as the ones who get their CPA license. A CPA title is given to any individual who successfully passes the examinati*** conducted by the UCPAE (United Certified Public Accountant Examination). Once you pass the CPA exam, you are also eligible to practice your profession in any state in the United States.

If you are a CPA, many organizati*** will want you rather than an unlicensed accountant. Having passed the CPA exam increases your competency and skills. You only have to prove to them that you are really qualified. Also, you can practice being a CPA on your own aside from being employed. If you are a CPA, you’ll perform activities in financial planning, estate planning, financial accounting, corporate finance, and many more. Since you are a licensed professional, you have greater resp***ibilities. To be able to renew your CPA license, you have to attend accounting-related seminars as your continuing education. So as not to forget what you learn in school, you can also do some self-study.

Formerly, the CIMA, or Chartered Institute of Management Accountants, was known as the Institute of Costs and Works Accountants in 1919. CIMA has its main headquarters in the United Kingdom. It is a professional body concerned with the 管理 of 会计 in the United Kingdom and other parts of the world. It is c***idered to be the biggest management accounting body in the world since it has more than 172,000 members.

What does CIMA do? It affords the opportunity to accounting graduates the qualification equivalent to a master’s degree. If you have passed CIMA’s 15 examination series, you’ll be able to obtain their qualification. The only condition you need to fulfill is to pass their exams, and you need to have at least three years of management accounting practice. Studying and learning is a never-ending process. Though others become successful, even if they don’t have a degree, try to do what you know. There’s nothing wrong in engaging yourself for several examinati*** and qualificati*** to reach your goal. As long as you have the heart for it, you can do what you know is best. Being a CPA and a qualified CIMA adds to your 自我 as a professional which not all people are able to do.

Summary:

- “CPA”代表“注册会计师”,而“CIMA”代表“特许管理会计师协会”

- 任何成功通过UCPAE(联合注册会计师考试)考试的个人均可获得注册会计师资格。

- CIMA是英国和世界上最大的会计管理专业机构。

- 作为一名注册会计师和一名合格的CIMA,你可以打开前方的机会之门。他们的福利包括升职和增加工资或薪金。

- 大多数组织和公司都喜欢与持牌注册会计师和合格CIMAs合作,因为他们的资格和能力记录都得到了证实。

- 发表于 2021-06-24 10:51

- 阅读 ( 219 )

- 分类:教育

你可能感兴趣的文章

注册会计师(cpa)和acca公司(acca)的区别

cpa与acca 由于注册会计师和会计准则都是指专业会计资格的会计术语,因此,了解注册会计师与会计准则的区别在某一时间点上可能会有所使用。尤其是对有兴趣的人来说,在进入会计专业之前,了解注册会计师和会计核算的...

- 发布于 2020-10-16 16:34

- 阅读 ( 161 )

aat公司(aat)和cima公司(cima)的区别

...与Â CIMA公司 AAT是指会计技术人员协会,CIMA是指特许管理会计师协会。这两个机构颁发管理技能证书。AAT和CIMA都是英国的认证机构。下面让我们看看两者之间的一些区别。 CIMA被认为是一个更专业的机构,主要提供管理会计和其...

- 发布于 2021-06-23 07:09

- 阅读 ( 292 )

cima公司(cima)和阿克(acca)的区别

...职业资格显得尤为重要。在日益增长的金融市场中,专业会计师不仅要处理企业的税务或簿记工作,而且要成为高素质的财务专家。这就是为什么全世界的会计机构都在不断努力跟上世界金融和会计的最新进展和变化。拥有职业...

- 发布于 2021-06-24 14:18

- 阅读 ( 190 )

cga公司(cga)和注册会计师(cpa)的区别

...领域的最新发展。这样做是为了确保这些专业机构的专业会计师仍然有能力更有效地处理国内和国际问题。这将有助于这些会计师跟上当前市场的变化,因此,他们将大大有助于世界各地的企业界和行业保持其财务运作和报告符...

- 发布于 2021-06-24 14:19

- 阅读 ( 464 )

cima公司(cima)和acma公司(acma)的区别

...俱增,公司认为有必要聘用有资格有效履行其职责的注册会计师。这就是为什么在管理会计中引入认证的原因。最广为人知的两个认证是CIMA和ACMA。虽然这两种认证都是针对管理会计专业人士的,但它们之间存在一定的差异。下...

- 发布于 2021-06-24 14:37

- 阅读 ( 262 )

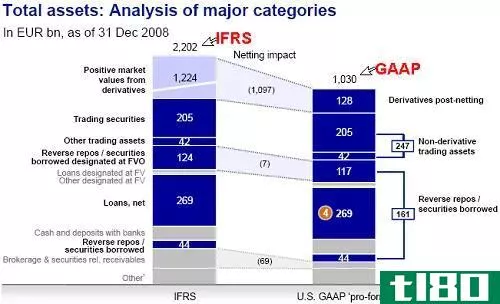

国际财务报告准则之间的差异(differences between ifrs)和美国会计准则(us gaap)的区别

... 总结 - 国际财务报告准则之间的主要差异(of key differences between ifrs) vs. 美国会计准则(us gaap) 因子 国际财务报告准则 美国公认会计准则 1. 资产评估 当抽象的东西存在活跃的市场时,资产可以向上重新评估。它还允...

- 发布于 2021-06-25 01:03

- 阅读 ( 407 )

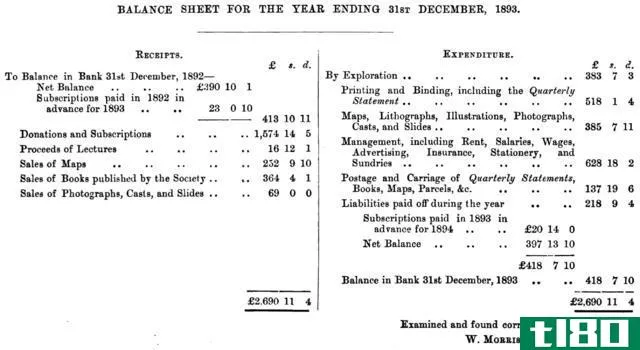

实际账户之间的差异(differences between real accounts)和名义账户(nominal accounts)的区别

一个财政年度的期末报表包含在该期间记录的不同账户中的若干交易的组成部分。企业在许多账户中记录交易,其中包括资产、权益、负债、收益、收入、损失和费用。 收入、损失和收益账户的余额在年末结清,也被称为名义...

- 发布于 2021-06-25 15:00

- 阅读 ( 456 )

自然神论(deism)和有神论(theism)的区别

...s through miracles or supernatural revelation. This is the main difference between dei** and thei**. 什么是自然神论(dei**)? 自然神论是一种宗教信仰,认为上帝创造了宇宙,建立了合理可理解的道德和自然法则,但不通过奇迹或超自然的启示干预人...

- 发布于 2021-06-28 00:23

- 阅读 ( 523 )

加利福尼亚州(ca)和注册会计师(cpa)的区别

...提供更好的就业机会和高薪。在各种课程中,CA,即特许会计师,是一个全世界公认的头衔,是授予合格会计师的专业称号,等同于美国的CPA(注册会计师)。 注册会计师与注册会计师的主要区别在于前者是指澳大利亚、加拿...

- 发布于 2021-07-09 08:11

- 阅读 ( 263 )

cima公司(cima)和acma公司(acma)的区别

...会计协会是由成本会计协会提供的证书课程印度成本管理会计师协会(ICAI)和巴基斯坦成本管理会计师协会(ICMAP)。CIMA是一个专业的认证课程,提供适当的培训管理会计师在该领域,它主要设在英国和英联邦国家。ACMA是由ICAI...

- 发布于 2021-07-10 00:21

- 阅读 ( 318 )